Annuity longevity protection is a crucial financial strategy that ensures you won’t outlive your savings, providing peace of mind as you navigate retirement.

This approach offers individuals a reliable income stream, allowing them to enjoy their golden years without the constant worry of financial shortfall. With various types of annuities available, understanding how they function and their benefits can play a significant role in your long-term financial well-being.

Understanding Annuity Longevity Protection

Annuity longevity protection is an essential concept in financial planning, especially for retirees concerned about the risk of outliving their savings. It provides a safety net by ensuring a consistent income stream during retirement, catering specifically to individuals’ needs for long-term financial security.Longevity protection within annuities refers to the financial tools designed to provide income for as long as an individual lives, thereby mitigating the risk of depleting one’s savings.

This is particularly important given that medical advancements and improved living standards have led to increased life expectancy. Annuities serve as instruments that convert a lump sum of savings into a steady income stream, which can last for several years or even the lifetime of the purchaser. This feature is crucial in a world where standard retirement accounts may not provide sufficient income as individuals age.

Types of Annuities for Longevity Protection

To effectively address the need for longevity protection, various types of annuities are available. Each type caters to different financial situations and goals, ensuring individuals can choose an option that best fits their retirement strategy. Below are key types of annuities that provide longevity protection:

- Immediate Annuities: These are purchased with a lump sum and begin payouts almost immediately, providing a steady income right from retirement. They are ideal for individuals who have retired and need immediate cash flow.

- Deferred Annuities: These allow individuals to invest a lump sum that grows tax-deferred until a future date, typically retirement. They can be beneficial for those who are still accumulating savings and want to lock in a future income stream.

- Lifetime Annuities: A specific type of immediate annuity that guarantees payments for the rest of the policyholder’s life, ensuring that individuals will not outlive their financial resources.

- Variable Annuities: These offer the potential for greater returns through investment options, but they come with added risks. They can include lifetime payout options that provide income for life, balancing growth potential with longevity security.

- Indexed Annuities: These are linked to a stock market index and offer a blend of growth potential and guaranteed income, providing a hedge against inflation while ensuring protection against market downturns.

Understanding these options is crucial as individuals plan their retirement income strategies. The right choice depends on factors such as current savings, expected retirement expenses, health status, and overall financial goals.

“Annuities provide a structured way to secure an income for life, granting peace of mind in retirement.”

Life Annuities

Life annuities are financial products designed to provide a steady stream of income for individuals during retirement. By converting a lump sum of money into regular payments, life annuities offer a solution for those looking to mitigate the risk of outliving their savings. This income typically continues for the duration of the annuitant’s life, making them a fundamental element in longevity protection strategies.The primary function of life annuities is to provide predictable and reliable income.

When an individual purchases a life annuity, they make a one-time payment or a series of payments to an insurance company, which then guarantees to pay out a specified amount for the rest of the individual’s life. Depending on the chosen terms, these payments can start immediately or be deferred until a later date. This structure not only alleviates the stress of managing investments but also ensures that retirees have the financial resources needed to maintain their lifestyle, regardless of how long they live.

Benefits of Incorporating Life Annuities into Retirement Planning

Integrating life annuities into retirement planning offers several compelling advantages that enhance financial security. These benefits can significantly influence the decision-making process regarding retirement income strategies.

- Longevity Insurance: Life annuities act as a hedge against the risk of outliving one’s assets. With the increasing life expectancy, having guaranteed income for life ensures that financial needs are met even in advanced age.

- Predictable Income Stream: Annuities provide fixed or variable payments, offering retirees peace of mind knowing their income is stable and can be budgeted accordingly.

- Tax Advantages: The growth of funds in a deferred annuity is often tax-deferred until withdrawal, potentially allowing for greater accumulation of wealth compared to taxable investment accounts.

- Personalization Options: Many life annuities can be tailored with features such as inflation protection or beneficiary options, allowing for a customized approach to meet individual financial goals.

Comparison with Other Retirement Income Options

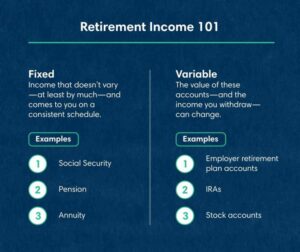

When considering longevity protection, it’s essential to evaluate how life annuities measure up against other retirement income options. Understanding the distinctions helps in making informed choices for a secure financial future.Traditional retirement income sources may include pensions, Social Security benefits, and personal savings portfolios. While these options can provide varying degrees of income, they often lack the guaranteed, lifetime payment structure that life annuities offer.

- Pensions: Unlike life annuities, pensions are becoming less common. Many companies do not offer them, and those who do might not provide sufficient income to cover living expenses adequately.

- Social Security: Social Security benefits can be a reliable income source but are generally not sufficient to cover all retirement expenses. Furthermore, the amount may be affected by changes in legislation and funding.

- Investment Portfolios: While personal savings and investment portfolios can provide income, they come with risks. Market volatility can affect the sustainability of withdrawals, posing a danger of depleting funds prematurely.

- Systematic Withdrawals: This strategy allows retirees to withdraw a set percentage from their savings each year. However, this approach does not guarantee income for life and can lead to uncertainty regarding how long the funds will last.

In summary, life annuities stand out as a reliable option for securing lifelong income, offering essential advantages that other retirement income sources may not provide. They represent a proactive approach to managing the financial implications of longevity, ensuring that retirees can enjoy their golden years without the stress of financial insecurity.

Factors Influencing Annuity Longevity Protection

Annuities can be a powerful tool for ensuring financial security throughout retirement, particularly when it comes to longevity protection. However, their effectiveness is not solely determined by the type of annuity selected; several key factors play a critical role in ensuring that these financial products serve their intended purpose. Understanding these factors is essential for anyone considering annuities as part of their retirement planning.

The performance and effectiveness of an annuity in providing longevity protection are influenced by a combination of age, health status, and investment choices. Each of these elements can significantly impact how long an annuity will last and how much income it can generate. For instance, older individuals may benefit from different annuity products compared to younger retirees, while those with health issues may need to consider their life expectancy when opting for annuity options.

Additionally, the type of investments chosen within the annuity can either enhance returns or limit growth, further affecting the overall longevity protection it offers.

Key Factors Impacting Annuity Performance

Understanding the factors that influence the effectiveness of annuities is vital for making informed decisions. Here are the primary factors to consider:

- Age: The age at which an individual purchases an annuity can determine the amount of guaranteed income they will receive. Generally, older individuals can secure higher monthly payments since they are expected to have a shorter life expectancy.

- Health: An individual’s health plays a crucial role in longevity planning. Those with chronic health issues or a shorter life expectancy might opt for products like life annuities, which provide higher payouts, compensating for a potentially shorter payout period.

- Investment Choices: The type of annuity chosen—fixed, variable, or indexed—can impact growth and payout potential. Fixed annuities provide stability, while variable annuities allow for investment in various assets, impacting returns based on market performance.

A clear understanding of these factors can help individuals tailor their annuity choices to better align with their retirement goals.

Pros and Cons of Annuity Types for Longevity Planning

Different types of annuities come with distinct advantages and disadvantages when it comes to planning for longevity. Below is a table that Artikels the pros and cons of various annuity types, providing a comprehensive overview for those considering their options.

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuities |

|

|

| Variable Annuities |

|

|

| Indexed Annuities |

|

|

Ultimately, the choice of annuity type should align with individual retirement goals, health status, and the desired level of risk. By considering these factors, individuals can make more informed decisions that enhance their financial stability throughout retirement.

Ending Remarks

In summary, embracing annuity longevity protection can be a game-changer in your retirement planning, ensuring that your financial resources last as long as you do. By considering life annuities and the factors influencing their effectiveness, you empower yourself to make informed decisions about your future.

Question Bank

What are the benefits of annuity longevity protection?

Annuity longevity protection provides a guaranteed income for life, reducing the risk of running out of savings and ensuring financial stability in retirement.

How do I choose the right annuity for longevity protection?

Selecting the right annuity involves assessing your financial goals, health status, and expected lifespan, alongside comparing different annuity types.

Can I withdraw money from an annuity?

Yes, but withdrawals may incur surrender charges and tax implications, so it’s essential to understand the terms of your specific annuity contract.

Are there risks associated with annuities?

Yes, potential risks include inflation affecting purchasing power and the possibility of lower returns compared to other investment options.

How does my age affect annuity longevity protection?

Your age impacts the cost and benefits of annuities, with younger individuals typically paying lower premiums for lifetime coverage.