With Annuity rates 2025 forecast at the forefront, this discussion highlights the key factors that may shape the landscape of annuity investments in the coming year. As investors and financial planners navigate through fluctuating economic conditions, understanding the nuances of annuity rates becomes essential for making informed decisions.

This overview will delve into the historical trends leading up to 2025, compare fixed and variable annuity rates, and provide insights into expert predictions based on economic indicators. By exploring these elements, you’ll gain a clearer picture of what to expect and how to strategize your investments effectively.

Annuity Rates Overview for 2025

As we look towards 2025, understanding annuity rates becomes essential for individuals planning for retirement and financial security. Annuity rates, which dictate how much income you can expect from an annuity investment, are influenced by a myriad of factors including market conditions, interest rates, and demographic trends. This overview provides insight into what to expect in the coming years.Several key factors will play a critical role in shaping annuity rates in 2025.

Factors Influencing Annuity Rates in 2025

Interest rates remain a primary driver of annuity rates. When interest rates rise, annuity rates typically follow suit, providing higher returns to investors. Similarly, the economic climate, including inflation rates and overall market performance, will impact investor confidence and thus influence annuity offerings. Another significant factor is demographic shifts, particularly the aging population. As more individuals reach retirement age, the demand for annuities is expected to increase, potentially driving up rates.

Insurer competition also affects annuity rates, as companies strive to attract clients with more attractive offerings.

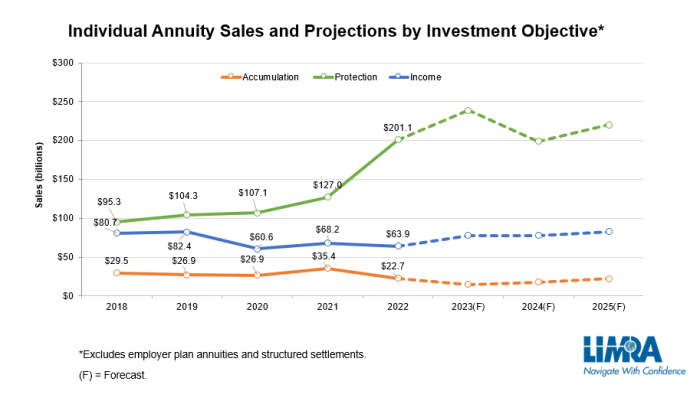

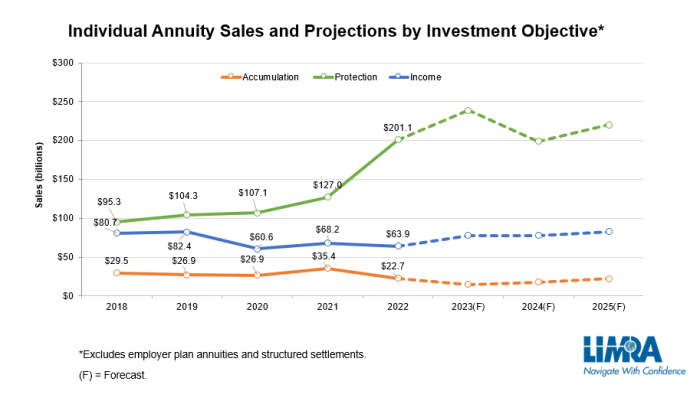

Historical Trends Leading Up to 2025

Analyzing historical data provides a clearer picture of how annuity rates have evolved over recent years. The following points illustrate key trends that have shaped the market:

- From 2010 to 2018, rates were generally low, often below 3%, as central banks maintained low-interest policies to stimulate economies post-recession.

- In 2019, there was a slight uptick in rates as economic conditions began to stabilize, with fixed annuities reaching around 3.5% in some cases.

- By 2021, the rates dipped again due to ongoing economic uncertainties caused by the pandemic, with many fixed annuities averaging around 2.5%.

- As of 2023, rates began to recover with projections indicating a move towards 4% for fixed annuities as interest rates from the Federal Reserve started to rise.

These trends indicate a recovery phase, with expectations that 2025 could see more favorable rates for consumers.

Comparison of Fixed vs. Variable Annuity Rates Projected for 2025

When considering annuities for investment, understanding the differences between fixed and variable annuities is crucial, especially as we approach 2025. Fixed annuities offer guaranteed returns and are generally seen as a safer investment, making them attractive to risk-averse individuals. In contrast, variable annuities allow for investment in various market-linked options, which can lead to higher returns but also come with increased risk.

The projected rates for these annuities in 2025 suggest a notable divergence between the two types:

| Type of Annuity | Projected Rate for 2025 | Risk Level |

|---|---|---|

| Fixed Annuity | 4% – 5% | Low |

| Variable Annuity | 5%

|

High |

The table highlights the expected stability of fixed annuities compared to the potentially higher returns of variable annuities, which can fluctuate based on market conditions.

Choosing between fixed and variable annuities will largely depend on individual risk tolerance and investment goals.

Predictions and Forecast for Annuity Rates in 2025

As we look ahead to 2025, several economic indicators suggest that annuity rates will experience notable fluctuations. Understanding these factors is crucial for individuals planning their retirement and investment strategies. Various elements, including inflation rates, interest rates, and overall economic growth, will play pivotal roles in shaping the annuity market.Expert predictions regarding interest rates are essential for anticipating changes in annuity offerings.

The financial landscape indicates that central banks may adopt either a tightening or easing approach based on inflation control and economic resilience. Analysts forecast that if interest rates remain stable or increase slightly, annuity rates could rise accordingly. Conversely, if rates drop, annuity providers might reduce payouts to maintain profitability.

Economic Indicators Impacting Annuity Rates

Several key economic indicators are expected to significantly influence annuity rates in 2025. Understanding these indicators helps in predicting the trends that will shape the market.

- Interest Rates: Central bank policies will directly affect interest rates. An increase may lead to higher annuity rates, while a decrease could result in lower rates.

- Inflation: Rising inflation can erode purchasing power, prompting insurance companies to adjust annuity rates to maintain their appeal.

- Employment Rates: A strong job market typically correlates with increased consumer confidence, potentially boosting demand for annuities.

- Market Performance: The stock market’s performance influences the general economic environment, impacting both investor sentiment and annuity pricing.

Expert Predictions on Interest Rates

Experts suggest that central banks will likely pursue a cautious approach, balancing interest rates to support economic growth while mitigating inflation concerns. This balancing act is crucial for the annuity market. The anticipated trend for interest rates over the next few years suggests a modest rise, expected to hover around 3% to 4% by 2025. This increase could enhance the attractiveness of fixed annuities, offering higher guaranteed returns compared to previous years.

“Stable interest rates combined with moderate inflation will create a favorable environment for annuity providers, potentially leading to better rates for consumers.”

Anticipated Annuity Rates for 2025

To provide a clearer picture of what consumers might expect, here is a table summarizing anticipated annuity rates across different types for 2025:

| Type of Annuity | Estimated Rate (%) |

|---|---|

| Fixed Annuity | 3.5% – 4.0% |

| Variable Annuity | 4.5% – 5.5% |

| Indexed Annuity | 4.0% – 5.0% |

| Immediate Annuity | 4.0% – 5.0% |

These estimated rates reflect the expected market conditions influenced by the economic indicators discussed earlier. Investors and retirees should consider these projections as they plan their financial futures.

Life Annuities and Their Significance in 2025

As we approach 2025, life annuities are poised to play a crucial role in securing long-term financial stability for retirees and those planning for retirement. These financial products offer a predictable income stream, making them an appealing option for individuals looking to ensure that their essential expenses are covered throughout their retirement years. Investing in life annuities can provide peace of mind, knowing that financial security is guaranteed for life.The benefits of life annuities extend beyond mere income provision.

They offer unique features such as tax-deferred growth, which can enhance the overall value of your investment. Additionally, life annuities can be customized with various options, such as inflation protection and joint-life payments, making them adaptable to individual needs. However, it’s important to understand how the projected changes in annuity rates for 2025 may affect these products.

Impact of Changes in Annuity Rates on Life Annuities

As we look toward 2025, fluctuations in interest rates and market conditions will influence annuity rates, which in turn will affect the attractiveness of life annuities. When interest rates rise, life annuity payouts typically increase, providing better value for new investors. Conversely, a decline in interest rates may result in lower payouts, making existing contracts less appealing.It’s essential to monitor economic forecasts and interest rate trends, as these will directly influence the returns on life annuities.

Investors should be aware that the pricing of life annuities may change in response to broader economic conditions, such as inflation and monetary policy adjustments.

Strategies for Selecting the Best Life Annuities

Choosing the right life annuity involves careful consideration of various factors, especially in light of anticipated market changes. Here are some key strategies to guide your selection process:To make informed decisions, consider the following aspects when evaluating life annuities:

- Compare Payout Rates: Different insurers may offer varying payout rates for life annuities. Review multiple quotes to identify the most favorable terms.

- Assess Additional Features: Look for annuities that include beneficial features such as inflation protection or death benefits, which can enhance your financial security.

- Evaluate Insurer Stability: Research the financial health and ratings of the insurance companies to ensure that your investment is secure over the long term.

- Consult Financial Advisors: Seek advice from financial professionals who can provide insights on how current and projected rates may impact your annuity options.

By implementing these strategies, investors can navigate the complexities of selecting life annuities in 2025, positioning themselves to maximize their long-term financial security.

“Investing in life annuities today could be the key to a financially stable tomorrow.”

Conclusion

In conclusion, the Annuity rates 2025 forecast reveals a dynamic environment influenced by various economic factors and expert insights. As we look ahead, it’s crucial to stay informed and consider how these projected changes may impact your financial security and investment choices. With the right knowledge, you can make decisions that align with your long-term financial goals.

Questions Often Asked

What factors influence annuity rates?

Annuity rates are influenced by interest rates, inflation, and economic conditions, as well as supply and demand in the insurance market.

How do fixed and variable annuity rates compare?

Fixed annuities offer guaranteed rates, while variable annuities fluctuate based on market performance, potentially providing higher returns but with greater risk.

What are the benefits of investing in life annuities?

Life annuities provide a steady income stream for life, offering financial security in retirement and the peace of mind of not outliving one’s savings.

How can I choose the best life annuity?

To choose the best life annuity, consider factors like the issuer’s financial strength, fee structures, payout options, and how they align with your retirement goals.

What economic indicators should I watch for 2025?

Key economic indicators include interest rates, inflation rates, and overall economic growth, as these can significantly impact annuity rates.