Best life annuities 2025 is a crucial topic for anyone planning for their retirement. As people seek financial stability in their golden years, understanding life annuities becomes essential. These financial products offer a steady income stream, catering specifically to retirees who want peace of mind.

Life annuities come in various forms, each designed to meet different financial needs. By exploring the best life annuities projected for 2025, individuals can better prepare for their future while evaluating how these options can enhance their retirement plans.

Understanding Life Annuities

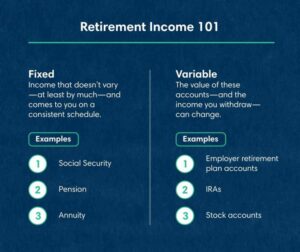

Life annuities are financial products designed to provide individuals with a steady stream of income, typically during retirement. They function by converting a lump sum of money into regular payments for a specified period or for the lifetime of the annuitant. This arrangement helps retirees manage their financial needs, ensuring they have a reliable source of income that can supplement social security or pensions.There are several types of life annuities available in the market, each differing in terms of structure, benefits, and payout options.

Understanding these variations can help retirees choose the most suitable product for their financial situation.

Types of Life Annuities

It’s essential for potential buyers to be aware of the different types of life annuities, as each type offers unique features and benefits that cater to various financial goals. Below are the primary categories of life annuities:

- Immediate Annuities: These start paying out almost immediately after a lump sum payment is made. They are popular among retirees who seek instant income.

- Deferred Annuities: Payments begin at a future date, allowing the invested funds to grow tax-deferred until withdrawals begin. This option suits those looking to save for retirement while still working.

- Fixed Annuities: These provide guaranteed payments for a specified period or for life, offering stability and predictability, which many retirees prefer.

- Variable Annuities: Payments vary based on the performance of the investment options chosen. They offer the potential for growth but come with greater risk.

The choice of annuity type depends on individual circumstances, including age, retirement goals, and risk tolerance. Each type serves different needs and financial strategies.

Benefits of Life Annuities for Retirees

Life annuities can significantly enhance the financial well-being of retirees, providing several advantages that are crucial during retirement years. These benefits include:

- Guaranteed Income: Life annuities ensure that retirees receive regular payments, regardless of market conditions, thus providing financial peace of mind.

- Longevity Protection: They protect against the risk of outliving savings, as payments continue for the lifetime of the annuitant.

- Tax Advantages: The growth on the investment is tax-deferred, and only the earnings are taxable upon withdrawal, which can be beneficial for tax planning.

- Customization: Options such as inflation protection or beneficiary payouts allow retirees to tailor annuities to their specific needs.

For example, a retiree who invests $100,000 in a fixed immediate annuity might receive monthly payments of approximately $500 for life, depending on factors such as age and current interest rates. This kind of predictable income stream can be invaluable for budgeting and managing monthly expenses.

“Life annuities provide a safety net that can help retirees manage their financial needs without the fear of outliving their savings.”

Best Life Annuities for 2025

As we approach 2025, the landscape of life annuities continues to evolve, offering a variety of options that cater to the diverse needs of retirees and those planning for their future. Life annuities provide a stable income stream, which can be crucial for long-term financial security. This discussion will highlight the top life annuity products projected for 2025, comparing their features, benefits, and rates, while also addressing essential factors for consumers to consider when selecting a life annuity.

Top Life Annuity Products for 2025

Several life annuity products are expected to stand out in the market for 2025, offering attractive rates and features to consumers. Below are some notable options:

- XYZ Fixed Income Annuity: This product features guaranteed returns, making it ideal for risk-averse individuals. The current projected rate is around 4.5% annually.

- ABC Indexed Annuity: Linking returns to a stock market index, this annuity provides the potential for higher gains while offering downside protection. Expected returns could range from 5% to 7%.

- 123 Variable Annuity: With investment options in various funds, this annuity allows for growth potential, albeit with higher risk. Average historical returns are around 6% to 8% annually depending on market performance.

The choice of these products reflects a balance between security and growth potential, catering to a variety of risk appetites.

Comparison of Features, Benefits, and Rates

When evaluating life annuities for 2025, it is essential to compare various features, benefits, and rates. Here’s a closer look at some of the criteria that matter most:

| Feature | XYZ Fixed Income | ABC Indexed | 123 Variable |

|---|---|---|---|

| Minimum Investment | $10,000 | $15,000 | $25,000 |

| Guaranteed Returns | Yes | No | No |

| Market Exposure | None | Limited | Full |

| Withdrawal Options | Flexible after 5 years | Penalty for early withdrawal | Varies by fund |

This table illustrates how products differ in terms of investment requirements, returns, and withdrawal flexibility, which can help consumers align their choices with their financial goals.

Factors to Consider When Selecting a Life Annuity

Selecting a life annuity requires careful consideration of several factors. Potential consumers should evaluate the following:

- Personal Financial Goals: Understanding whether you seek income stability or growth potential is crucial in choosing the right product.

- Market Conditions: Awareness of interest rates and stock market trends can inform decisions, as they directly impact annuity rates.

- Fees and Charges: It’s essential to understand any associated fees that could affect overall returns. Look for transparent fee structures.

- Insurance Company Rating: The financial stability of the issuing company is vital; consider companies with strong ratings for reliability.

- Flexibility and Options: Assess the degree of flexibility in withdrawals and the availability of options for changing investments within variable annuities.

By evaluating these factors, consumers can make informed decisions that align with their financial objectives and retirement needs.

Planning for Retirement with Life Annuities

Life annuities can play a vital role in a comprehensive retirement plan, providing a steady income stream that can help mitigate the risk of outliving savings. As individuals approach retirement, understanding how to effectively incorporate life annuities into their financial strategy becomes increasingly important. This section will cover strategies for integrating life annuities, Artikel their advantages and disadvantages, and discuss methods for evaluating them in comparison to other retirement income options.

Strategies for Incorporating Life Annuities

When planning for retirement, incorporating life annuities requires careful consideration of several factors. A well-rounded approach involves assessing current financial needs, future expenses, and personal health situations. This can help to determine the right type and amount of annuity. Below are some effective strategies to consider:

- Assessing Income Needs: Estimate your living expenses during retirement, including healthcare and lifestyle choices, to determine how much guaranteed income is necessary.

- Diversifying Income Sources: Combine life annuities with other income sources such as Social Security, pensions, and investment portfolios to create a balanced income plan.

- Utilizing Different Types of Annuities: Explore various types of life annuities, such as immediate or deferred annuities, to find the best fit for your timeline and financial goals.

- Consulting with Financial Advisors: Engage professionals who specialize in retirement planning to tailor a strategy that includes life annuities, ensuring alignment with your long-term objectives.

Pros and Cons of Using Life Annuities

Understanding the advantages and disadvantages of life annuities is crucial for making informed decisions. The following table Artikels the key pros and cons associated with using life annuities for retirement income:

| Pros | Cons |

|---|---|

| Provides guaranteed income for life, reducing the risk of outliving savings. | Once funds are converted into an annuity, they are typically illiquid and may not be accessible in emergencies. |

| Offers a predictable monthly cash flow, aiding in budget management. | Fees and commissions can be high, impacting overall returns. |

| Can be customized with various options, such as inflation protection or survivor benefits. | Potential for lower overall returns compared to other investments, particularly in low-interest environments. |

| Reduces anxiety about market fluctuations affecting retirement income. | Complex products can make it difficult to understand the terms and conditions, leading to potential misalignment with personal goals. |

Evaluating Life Annuities Against Other Retirement Income Options

When considering life annuities, it’s important to evaluate them alongside other retirement income solutions. This comparison should involve analyzing factors such as risk, returns, and liquidity. Here are some effective methods for this evaluation:

- Comparative Return Analysis: Review historical performance of life annuities versus stock market investments, bonds, or mutual funds to gauge how they stack up in terms of growth potential.

- Risk Assessment: Assess the stability and reliability of various income sources. Life annuities offer guaranteed payments, while other investments may be subject to market volatility.

- Liquidity Considerations: Determine how quickly you can access funds in case of emergencies. Life annuities typically lack liquidity compared to other investment vehicles.

- Tax Implications: Analyze the tax treatment of different income types, as annuity payouts may be taxed differently than capital gains or dividends from investments.

Final Thoughts

In summary, the journey through Best life annuities 2025 Artikels the importance of making informed choices for a secure retirement. By considering the top products and their features, retirees can effectively incorporate life annuities into their financial planning. Ultimately, the right life annuity can offer not just income, but peace of mind for the years ahead.

Essential FAQs

What are life annuities?

Life annuities are financial products that provide a guaranteed income for life in exchange for a lump sum payment.

How do I choose the best life annuity?

Consider factors such as payout options, fees, insurer’s financial strength, and your personal retirement needs when selecting an annuity.

Can I access my money in a life annuity?

Generally, life annuities do not allow early withdrawals without penalties, as they are designed to provide long-term income.

Are life annuities suitable for everyone?

They are more suitable for individuals seeking guaranteed income during retirement, but may not be ideal for those who prefer liquidity.

What is the difference between fixed and variable life annuities?

Fixed annuities provide a guaranteed return, while variable annuities allow for investment in various assets, which can lead to fluctuating payouts.