Life annuities for retirement planning offer a unique solution for individuals looking to secure their financial future during their golden years. These financial products provide a steady stream of income, ensuring that retirees can enjoy their lives without the stress of managing their savings. With various types of life annuities available, understanding their role in a comprehensive retirement strategy is essential for anyone looking to make informed decisions.

In essence, life annuities serve as a safety net, offering financial security and peace of mind by addressing the uncertainty of how long one might live. This overview will delve into the benefits of life annuities, the factors to consider when selecting them, and how they compare to other retirement income sources.

Introduction to Life Annuities

Life annuities serve as a pivotal financial tool for individuals planning their retirement. Essentially, life annuities are insurance products designed to provide guaranteed income for the lifetime of the annuitant, acting as a hedge against the risk of outliving one’s savings. This income stream can be particularly beneficial for retirees seeking financial stability, allowing them to maintain their lifestyle without the fear of depleting their resources.There are several types of life annuities available, each tailored to meet different financial needs and preferences.

The most common types include fixed life annuities, which provide a predetermined income amount; variable life annuities that offer payments based on investment performance; and indexed life annuities, where returns are linked to a specific stock market index. Understanding these different options is crucial for retirees to ensure that their choice aligns with their financial goals and risk tolerance.

Types of Life Annuities

In retirement planning, selecting the appropriate type of life annuity can significantly impact one’s financial landscape. The following are key types of life annuities:

- Fixed Life Annuities: These provide a steady, guaranteed income for the rest of the annuitant’s life, allowing for predictable financial planning.

- Variable Life Annuities: Payments fluctuate based on the performance of investment portfolios chosen by the annuitant, offering potential for higher returns but with increased risk.

- Indexed Life Annuities: These combine features of fixed and variable annuities, providing returns linked to a stock market index while ensuring a minimum guaranteed payout.

- Immediate Life Annuities: Payments begin almost immediately after a lump-sum investment, making them suitable for those nearing retirement.

- Deferred Life Annuities: These allow individuals to invest a lump sum, with payouts starting at a future date, enabling the accumulation of savings over time.

Incorporating life annuities into an overall retirement strategy can provide a robust framework for managing income during retirement years. With the financial landscape often marked by uncertainties such as market volatility and inflation, life annuities offer a level of security that can complement other retirement savings vehicles like 401(k)s and IRAs.

“The peace of mind that comes from knowing you have a guaranteed income stream can greatly enhance your retirement experience.”

A well-planned strategy might include a mix of life annuities along with other income sources to create a diversified financial portfolio. This approach not only secures a stable income but also allows retirees to invest in growth-oriented assets, striking a balance between risk and reward.

Benefits of Life Annuities for Retirement

Life annuities offer several compelling advantages for retirees looking to secure their financial future. They are designed to provide a steady stream of income for the remainder of one’s life, alleviating the stress associated with managing finances during retirement. The key benefits of life annuities include enhanced financial security, effective management of longevity risk, and a comparison with other retirement income sources that highlights their unique advantages.

Financial Security in Retirement

One of the primary benefits of life annuities is the financial security they provide by guaranteeing a consistent income stream. Unlike other investment options that may be subject to market fluctuations, a life annuity ensures that retirees will receive a predetermined amount of money regularly, which can cover essential living expenses. This can be particularly advantageous for retirees who may have limited savings or uncertain market exposure.

For instance, consider a retiree who purchases a life annuity with a lump sum of $300,000. Depending on their age and the terms of the annuity, they could receive a monthly payment of approximately $1,500 for the rest of their life. This predictable income can help them budget more effectively, knowing that their basic needs will be met without the constant worry of market downturns.

Managing Longevity Risk

Longevity risk, the possibility of outliving one’s savings, is a significant concern for retirees. Life annuities address this risk by providing payments for as long as the annuitant lives, thereby removing the worry of depleting retirement funds. This aspect is especially crucial given the increasing life expectancy globally; many individuals are now living well into their 80s and 90s. For example, if a 65-year-old retiree purchases a life annuity, they may not only receive payments until their death but could also benefit their surviving spouse if a joint-life annuity is selected.

This ensures that both individuals have financial support, further mitigating the impact of longevity risk on their retirement planning.

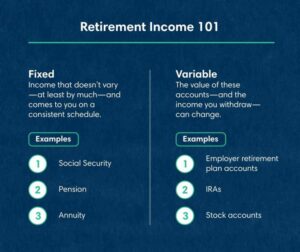

Comparison with Other Retirement Income Sources

When comparing life annuities with other retirement income sources, such as Social Security, pension plans, or investment portfolios, several key distinctions emerge. Life annuities stand out due to their guaranteed income aspect, while other sources may be subject to changes based on market performance, legislation, or personal management decisions.For instance, Social Security benefits can be influenced by various factors like age of claiming and overall earnings history, which may lead to unpredictable retirement income.

Furthermore, pension plans may not fully cover retirees’ needs, especially as costs of living increase. Investment portfolios, while potentially lucrative, carry risks associated with market volatility and require active management to sustain income levels.In contrast, life annuities simplify retirement planning, providing a straightforward and reliable income stream that can be relied upon without constant monitoring or adjustments. This stability is particularly appealing in volatile economic conditions, reinforcing the attractiveness of life annuities in a comprehensive retirement strategy.

Life annuities offer a unique blend of security and predictability, making them a valuable component of retirement planning.

Factors to Consider When Choosing Life Annuities

Selecting the right life annuity can significantly impact your retirement income and overall financial security. With various options available, it’s essential to assess different features and external conditions that may influence your decision. Understanding these factors ensures that you choose an annuity that aligns with your financial goals and retirement needs.Interest rates and market conditions play a vital role in the performance and appeal of life annuities.

As interest rates fluctuate, they can directly affect the payouts offered by annuities. When rates are low, the income generated by fixed annuities might not keep pace with inflation, potentially diminishing purchasing power over time. Conversely, in a high-interest-rate environment, the returns on fixed indexed or variable annuities may be more attractive. Additionally, market conditions can impact the performance of variable annuities, which are linked to investments in stock and bond markets.

Hence, evaluating the current economic environment is crucial before making a selection.

Key Features to Evaluate

When considering a life annuity, it’s important to analyze several key features. These features can influence the annuity’s benefits, costs, and suitability for your financial situation. The following points highlight essential aspects to evaluate:

- Type of Annuity: Determine whether a fixed, variable, or indexed annuity aligns with your risk tolerance and income needs.

- Payout Options: Evaluate the different payout structures available, such as lifetime income, period certain, or joint-life options, to suit your retirement plan.

- Fees and Charges: Understand the associated fees, including surrender charges, management fees, and any other costs that may impact your overall returns.

- Inflation Protection: Explore options for inflation-adjusted payouts to maintain purchasing power over time.

- Death Benefit Features: Consider whether the annuity offers a death benefit for beneficiaries, providing additional financial security.

Impact of Interest Rates and Market Conditions

Interest rates and market conditions significantly influence your annuity selection. The choice between fixed and variable annuities can be heavily swayed by current economic indicators. For example, in a low-interest environment, fixed annuities may yield lower payouts, which might prompt retirees to consider variable annuities with potential growth linked to market performance.

“Interest rates affect the attractiveness of annuities, where lower rates generally lead to lower payouts and potential adjustments in investment strategies.”

As market conditions fluctuate, the performance of variable annuities can vary widely. Understanding the underlying investments and market risks associated with these products is essential for making informed decisions. A thorough assessment of these external factors will ensure you select an annuity that not only meets your immediate needs but also adapts to changing economic landscapes.

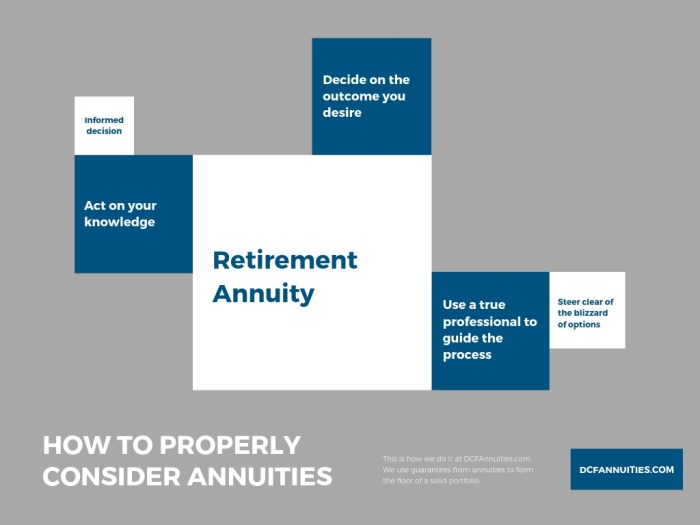

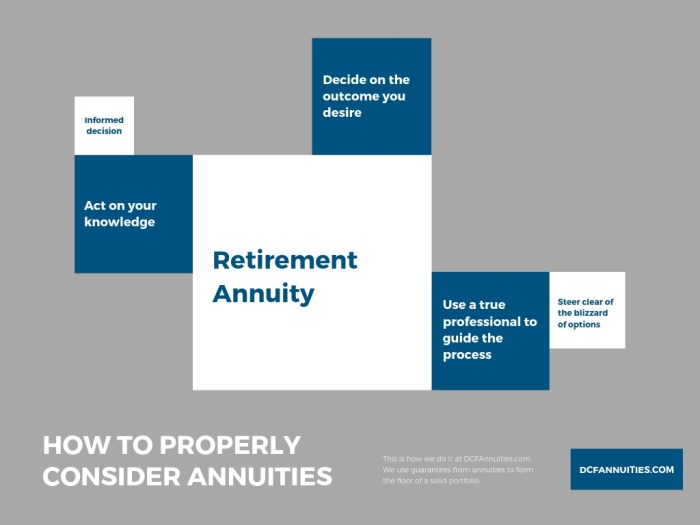

Questions to Ask a Financial Advisor

Engaging with a financial advisor can provide valuable insights into the complexities of life annuities. It is important to ask pertinent questions that can help clarify your understanding and ensure you make informed choices. Here are significant inquiries to consider:

- What types of life annuities do you recommend based on my financial goals?

- How do current interest rates impact the annuities you suggest?

- What are the total fees associated with each annuity option?

- How can I tailor my annuity to include inflation protection?

- What is the expected payout schedule, and how does it fit my retirement income needs?

Last Recap

In conclusion, life annuities for retirement planning stand out as a reliable option for those aiming to secure their financial independence in retirement. By providing guaranteed income and managing longevity risk, they play a crucial role in a well-rounded retirement strategy. As you navigate your options, consider the key features and consult with a financial advisor to tailor a plan that best fits your needs and aspirations.

Frequently Asked Questions

What are life annuities?

Life annuities are financial products that provide guaranteed income for the lifetime of the annuitant in exchange for a lump sum payment or a series of payments.

How do life annuities help manage longevity risk?

Life annuities mitigate longevity risk by ensuring that individuals receive regular payments for as long as they live, regardless of how long that may be.

Can life annuities be customized?

Yes, many life annuities offer customization options, allowing individuals to choose features such as payment frequency, duration, and death benefits.

Are life annuities a good investment?

Life annuities can be a good investment for those seeking predictable income in retirement, but it’s essential to evaluate your overall financial situation and needs.

What factors affect the payout of life annuities?

Payout amounts for life annuities are influenced by factors such as the age and health of the annuitant, the type of annuity selected, and current interest rates.