As the Lifetime annuity calculator takes center stage, it opens up an insightful exploration into the realm of financial security through lifetime annuities. These annuities are essential tools for individuals seeking a steady income stream in retirement, enabling them to plan their futures with confidence.

Understanding lifetime annuities involves grasping their significance in financial planning, the various types available, and weighing the advantages against potential drawbacks. Whether you’re looking for guaranteed income or considering different investment strategies, the lifetime annuity calculator serves as a powerful ally in making informed decisions.

Understanding Lifetime Annuities

Lifetime annuities are financial products designed to provide guaranteed income for the lifetime of the annuitant, making them a crucial element in retirement planning. They help individuals secure a steady cash flow during retirement, alleviating concerns about outliving their savings. This stability can be particularly significant for those who may not have other sources of sustainable income.There are various types of lifetime annuities available in the market, each catering to different needs and preferences.

These annuities can vary in terms of structure and benefits, making it important to understand the distinctions among them.

Types of Lifetime Annuities

The primary types of lifetime annuities include:

- Immediate Annuities: These begin payments almost immediately after a lump sum is paid. They’re ideal for those who are already retired and want immediate income.

- Deferred Annuities: Payments start at a future date, allowing the investment to grow over time before withdrawals begin. This is advantageous for younger individuals or those still in the workforce.

- Fixed Lifetime Annuities: These provide a guaranteed payout amount for the lifetime of the annuitant, offering predictability in financial planning.

- Variable Lifetime Annuities: Payments fluctuate based on the performance of investment options chosen by the annuitant, providing the potential for higher returns but also increasing risk.

- Joint Lifetime Annuities: These cover two individuals, ensuring income for both parties, which is beneficial for couples who wish to secure financial stability together.

Understanding these options allows individuals to select an annuity that aligns with their financial goals and retirement strategies.

Advantages and Disadvantages of Lifetime Annuities

Lifetime annuities come with distinct pros and cons that should be carefully weighed before making an investment.The advantages include:

- Guaranteed Income: Provides a reliable income stream regardless of market conditions, significantly reducing the risk of outliving one’s savings.

- Simplicity: Once set up, these annuities require minimal management, offering peace of mind for retirees.

- Potential Tax Benefits: Income from annuities is often taxed at a lower rate compared to regular income, enhancing the overall return on investment.

However, there are also disadvantages to consider:

- Reduced Liquidity: Funds committed to an annuity are not easily accessible, which can be a drawback in emergencies or unexpected financial needs.

- Inflation Risk: Fixed annuities may not keep pace with inflation, potentially diminishing purchasing power over time.

- Fees and Commissions: Many annuities come with high fees, which can eat into returns, making it crucial to evaluate the costs involved.

Understanding both the benefits and drawbacks of lifetime annuities is essential for making informed financial decisions.

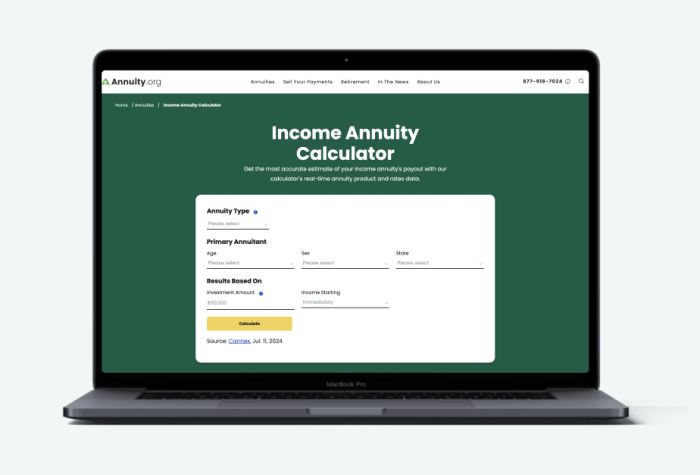

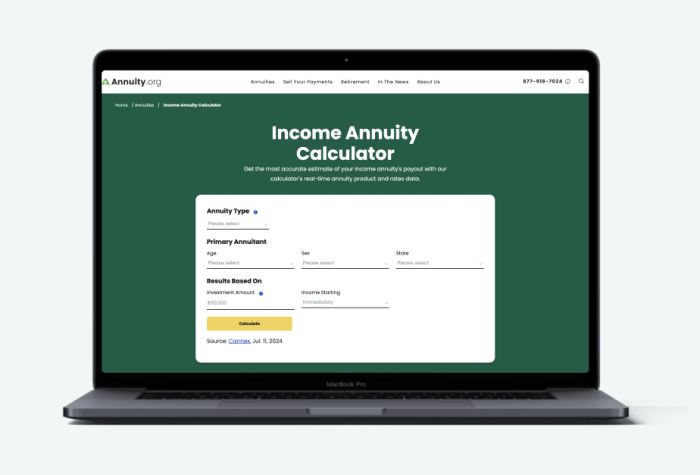

Utilizing a Lifetime Annuity Calculator

Using a lifetime annuity calculator can be a powerful tool in planning for retirement. It helps individuals understand how much income they can expect to receive throughout their retirement years based on various inputs. A clear understanding of how to navigate the calculator will enhance your financial planning and ensure you make informed decisions regarding your retirement savings and investments.

The lifetime annuity calculator requires several key inputs to provide accurate payout estimates. Understanding these variables is essential for making the most of the tool and for tailoring your retirement plan according to your specific needs. Below are the necessary inputs and a look into how varying these can impact the outcome.

Key Inputs for Accurate Calculations

When using a lifetime annuity calculator, there are several important inputs to consider. These inputs directly influence the payout amount and understanding them is crucial. The following list Artikels these key variables:

- Age: Your current age or the age at which you plan to start receiving income. This affects the duration of payments.

- Gender: Annuity providers often consider gender as women typically live longer than men, potentially affecting payout amounts.

- Investment Amount: The initial premium or lump sum paid into the annuity. The larger the investment, the higher the potential payout.

- Interest Rate: The rate at which the investment grows. Higher interest rates can lead to larger payouts.

- Payment Frequency: How often you wish to receive payments (monthly, quarterly, annually). More frequent payments may slightly reduce the payout amount.

- Type of Annuity: Whether it is a fixed or variable annuity can influence the payout structure and potential growth.

Each of these factors plays a significant role in determining the final annuity payouts and understanding their impact can lead to more effective planning.

Examples of Variable Impact on Payout Amounts

To illustrate how different variables can affect annuity payouts, consider the following examples. These scenarios use typical values to demonstrate the possible outcomes.

| Input Variable | Scenario 1 | Scenario 2 |

|---|---|---|

| Age | 65 | 70 |

| Investment Amount | $100,000 | $100,000 |

| Interest Rate | 3% | 3% |

| Payout Amount (Monthly) | $500 | $550 |

In these scenarios, the older individual at 70 receives a higher monthly payout than the 65-year-old. This is due to the shorter expected payout duration. Additionally, if we adjust the interest rate, we might see even more significant changes:

| Input Variable | Scenario 1 | Scenario 2 |

|---|---|---|

| Age | 65 | 65 |

| Investment Amount | $100,000 | $100,000 |

| Interest Rate | 3% | 5% |

| Payout Amount (Monthly) | $500 | $600 |

In this example, an increase in the interest rate from 3% to 5% leads to a noticeable increase in the monthly payout. Understanding these dynamics is crucial for effectively utilizing a lifetime annuity calculator and making informed retirement decisions.

Comparing Life Annuities with Other Investment Options

Life annuities serve as a unique financial tool designed to provide a steady income stream during retirement. Unlike other investment options, they offer guaranteed payments over the annuitant’s lifetime, which can be appealing for those seeking financial stability. In this section, we will explore how life annuities compare to other investment vehicles like mutual funds and fixed deposits, helping individuals make informed decisions about their retirement planning.

Differences Between Life Annuities and Mutual Funds

Life annuities and mutual funds serve distinct purposes in a financial portfolio. Life annuities are primarily focused on providing a guaranteed income for life, whereas mutual funds are investment vehicles that pool money from many investors to purchase securities. Notable differences include:

Return Structure

Life annuities offer fixed, predictable payments, while mutual funds can yield variable returns based on market performance.

Risk Factor

Life annuities involve lower risk as they guarantee income regardless of market fluctuations, whereas mutual funds carry market risk and may lead to losses.

Investment Horizon

Life annuities are typically long-term investments aimed at retirement, while mutual funds can be short or long-term, depending on the investor’s strategy.Considering these differences, individuals who prioritize a secured income over a long duration may prefer life annuities, while those seeking growth and are comfortable with market risk might lean towards mutual funds.

Comparison of Life Annuities and Fixed Deposits

When evaluating life annuities against fixed deposits (FDs), it’s crucial to examine various factors such as returns, risk, and liquidity. Below is a comparative table highlighting these aspects:

| Feature | Life Annuities | Fixed Deposits |

|---|---|---|

| Returns | Guaranteed income for life, typically lower than potential market returns | Fixed interest rate, generally lower than inflation rates |

| Risk | Low risk, income guaranteed regardless of market conditions | Low risk, but returns may not keep pace with inflation |

| Liquidity | Low liquidity; annuity payments are periodic and cannot be withdrawn as a lump sum | High liquidity; funds can be withdrawn at maturity or with penalties |

Understanding these distinctions can help individuals determine which option aligns best with their financial goals and risk tolerance.

Scenarios for Choosing Life Annuities Over Traditional Investment Vehicles

Certain life situations might lead individuals to prefer life annuities over traditional investments. For example, retirees looking for a stable source of income with no concern for market volatility may find life annuities particularly appealing. Additionally, individuals who have trouble managing investments due to lack of time or expertise could benefit from the simplicity and predictability offered by annuities. Furthermore, those without a substantial retirement fund might opt for life annuities if they wish to ensure that they will not outlive their savings, providing a safety net that traditional investments may not guarantee.In essence, life annuities can be a valuable component of a retirement strategy, offering benefits that other investment options may not provide, particularly in terms of guaranteed financial security.

End of Discussion

In summary, utilizing a lifetime annuity calculator not only simplifies the complexities of financial planning but also empowers individuals to compare annuities with other investment vehicles. By understanding how different variables influence payouts, you can make educated choices that suit your financial goals and future needs.

Commonly Asked Questions

What is a lifetime annuity?

A lifetime annuity is a financial product that provides guaranteed income for the rest of your life in exchange for a lump sum payment.

How does a lifetime annuity calculator work?

The calculator uses inputs such as age, gender, and investment amount to estimate the monthly payouts you can expect from a lifetime annuity.

Are lifetime annuities a good investment?

They can be a good investment for individuals seeking predictable income in retirement, although they come with specific fees and terms that should be understood.

Can I withdraw money from a lifetime annuity?

Typically, lifetime annuities are designed for income rather than withdrawals; however, some may offer options for partial withdrawals or a cash surrender value.

What factors influence annuity payouts?

Key factors include the age and health of the annuitant, the amount invested, interest rates, and the type of annuity chosen.