Exploring Low-risk retirement income options opens the door to a world where financial security meets peace of mind. As retirees seek to navigate the complexities of sustaining an income without the fear of market volatility, understanding these options becomes paramount.

Low-risk income sources are designed to provide stability and predictability, allowing retirees to confidently manage their finances. From life annuities to diversified portfolios, the landscape is rich with opportunities tailored for those who prefer a conservative approach to investing their hard-earned savings.

Understanding Low-Risk Retirement Income Options

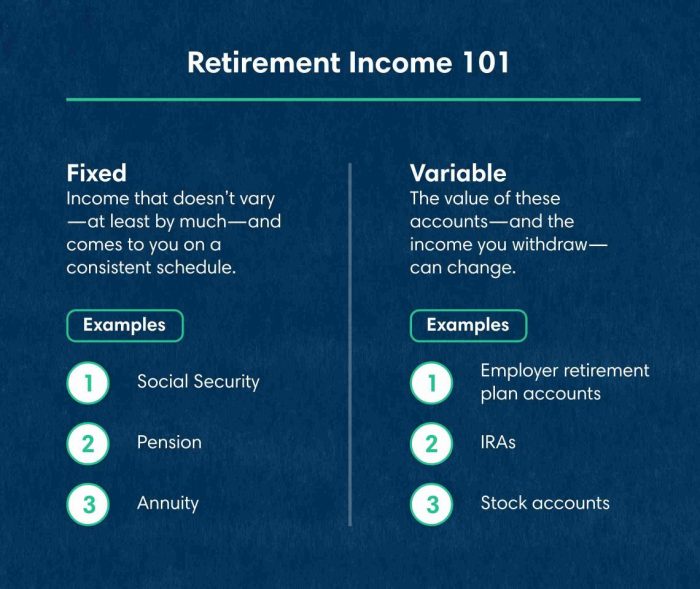

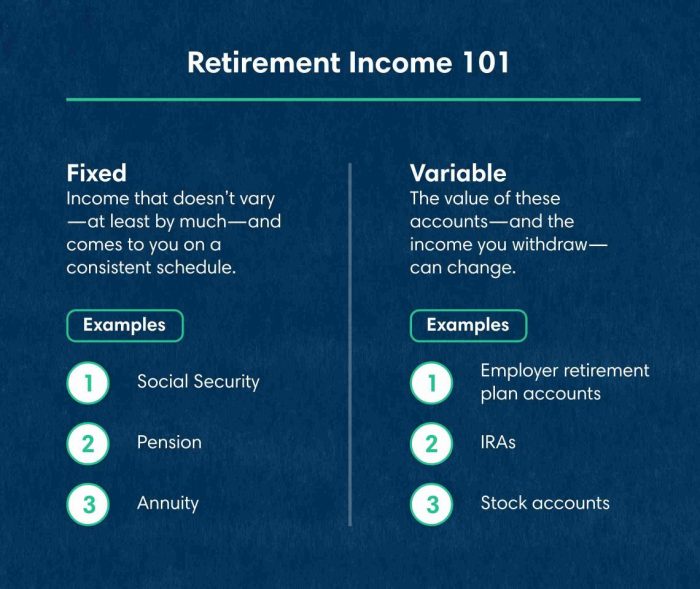

Low-risk retirement income options are essential for ensuring financial stability during retirement. As individuals exit the workforce, it’s crucial to have reliable income sources that minimize the potential for loss. These options allow retirees to enjoy their golden years without the fear of market fluctuations affecting their financial well-being.Low-risk retirement income options refer to investment strategies or vehicles designed to preserve capital while generating income.

These options are significant because they help retirees maintain their standard of living without exposing their savings to the volatility of the stock market. Utilizing low-risk options can be a strategic choice for those who prioritize security over high returns, especially in the unpredictable financial landscape.

Popular Low-Risk Investment Vehicles

Several investment vehicles are available that cater to those seeking low-risk retirement income. Understanding these options can empower retirees to make informed decisions. Here are some of the most common low-risk investment vehicles:

- Bonds: Government and municipal bonds are often considered safe investments. They provide fixed interest payments, and the principal is returned at maturity, making them a stable income source.

- Certificates of Deposit (CDs): Offered by banks, CDs typically provide higher interest rates than regular savings accounts. They are federally insured, making them a secure option for preserving principal while earning interest.

- Fixed Annuities: These insurance products guarantee a fixed return on investment, providing retirees with regular income for a specified period or for life, depending on the contract terms.

- Money Market Accounts: These accounts offer higher interest rates than traditional savings accounts while providing easy access to funds. They are typically insured by the FDIC up to certain limits.

- Dividend-Paying Stocks: While stocks are inherently riskier, certain established companies offer dividends, providing a steady income stream while potentially appreciating in value.

Relying on low-risk income sources comes with both benefits and drawbacks. Understanding these can help retirees create a balanced income strategy.

Low-risk investments are designed to protect capital while providing predictable income.

The benefits include increased financial security, reduced stress related to market volatility, and predictable income streams, which can help with budgeting and planning. However, there are drawbacks as well, such as lower potential returns compared to higher-risk investments, which may not keep pace with inflation. Retirees must evaluate their risk tolerance and financial goals to determine the right mix of income sources for their retirement.

Ultimately, choosing low-risk retirement income options can provide peace of mind, allowing retirees to focus on enjoying their time rather than worrying about their finances.

Life Annuities as a Low-Risk Income Option

Life annuities are a popular choice for retirees seeking a dependable income stream. By converting a lump sum payment into guaranteed monthly payments for a specified period or the lifetime of the retiree, these financial products provide peace of mind and financial security during retirement.Life annuities function by allowing individuals to pay a premium to an insurance company in exchange for a series of income payments.

The amount received typically depends on factors such as the individual’s age, gender, and the premium paid. This mechanism provides retirees with a steady income, which can be crucial for covering living expenses, healthcare costs, and maintaining a comfortable lifestyle.

Types of Life Annuities

Understanding the various types of life annuities can help retirees make informed decisions based on their financial needs and goals. Here are the most common forms:

- Single Premium Immediate Annuity (SPIA): This type provides immediate income, starting as soon as the premium is paid. It’s ideal for retirees who need quick access to funds.

- Deferred Income Annuity (DIA): This option delays payments until a future date chosen by the retiree. It’s suitable for those who want to secure income later in retirement.

- Fixed Indexed Annuity: This type links the payment amounts to a stock market index, offering potential for higher returns while still providing a guaranteed minimum payout.

- Qualified Longevity Annuity Contract (QLAC): This allows individuals to defer annuity payments until they reach a specified age, thereby reducing required minimum distributions from retirement accounts.

Choosing between these options depends on individual financial situations and retirement plans. It’s important to consider factors such as immediate income needs, risk tolerance, and long-term financial goals when selecting the right type of life annuity.

Advantages of Life Annuities

Life annuities offer several benefits compared to other income options. They can play a vital role in a comprehensive retirement strategy:

- Guaranteed Income: Life annuities ensure a steady income stream for life, reducing the risk of outliving one’s savings.

- Predictability: Monthly payment amounts remain consistent, aiding in budget planning and financial management.

- Tax Advantages: A portion of each payment may be tax-free, especially if the annuity is funded with after-tax dollars.

- Protection from Market Volatility: Unlike investments in stocks or bonds, life annuities are insulated from market fluctuations, ensuring stability.

Furthermore, life annuities can be customized with options such as survivor benefits or inflation protection, enhancing their appeal as a low-risk income solution. For retirees looking for a reliable and simplified approach to managing their retirement income, life annuities present an attractive option.

Diversifying Low-Risk Income Streams

In retirement, having a secure and predictable income is crucial for maintaining your lifestyle. Diversification plays a key role in a low-risk retirement income strategy by spreading your investment across various income streams to reduce risk. By not putting all your eggs in one basket, you can better withstand market fluctuations and ensure a more stable financial future.Combining various low-risk income options can create a balanced portfolio that meets your financial needs while minimizing exposure to any single source of risk.

This strategy allows you to tap into different income sources that can complement each other, thereby enhancing your overall financial resilience.

Examples of Combined Low-Risk Income Options

To illustrate how diversification can work in practice, consider the following combination of low-risk income sources. Each source contributes differently to your overall income and risk profile.

| Income Source | Potential Yield (%) | Risk Level |

|---|---|---|

| U.S. Treasury Bonds | 1.5 – 3.0 | Very Low |

| High-Quality Corporate Bonds | 3.0 – 5.0 | Low |

| Fixed Annuities | 2.5 – 4.5 | Low |

| Dividend-Paying Stocks | 2.0 – 4.0 | Moderate |

| Real Estate Investment Trusts (REITs) | 4.0 – 8.0 | Moderate |

The table above provides a snapshot of various income sources that can be included in a low-risk retirement portfolio. For instance, combining U.S. Treasury Bonds with high-quality corporate bonds and fixed annuities can create a robust foundation of low-risk income. This mixture ensures that even if one source underperforms, the others can help stabilize your overall income.Incorporating dividend-paying stocks and REITs can add a layer of growth potential to your portfolio.

While they carry slightly higher risks, they can enhance your income stream significantly, especially during inflationary periods.

“By diversifying low-risk income streams, retirees can achieve a more stable financial future with reduced exposure to market volatility.”

Closing Notes

In conclusion, Low-risk retirement income options serve as a crucial foundation for a secure and comfortable retirement. By leveraging a mix of reliable income sources, retirees can create a sustainable financial strategy that minimizes risks while maximizing peace of mind, ultimately leading to a more fulfilling retirement experience.

Answers to Common Questions

What are low-risk retirement income options?

Low-risk retirement income options include investment vehicles like bonds, life annuities, and dividend-paying stocks, which aim to provide steady income with minimal risk.

How do life annuities work?

Life annuities provide regular payments to retirees in exchange for an upfront lump sum, ensuring a steady income for the rest of their lives.

What are the benefits of diversifying low-risk income streams?

Diversifying low-risk income streams helps mitigate risks and provides a more stable overall income by combining different sources that respond differently to market conditions.

Are low-risk investments suitable for everyone?

While low-risk investments are ideal for those seeking stability, it’s essential to assess individual risk tolerance and financial goals before finalizing an investment strategy.

What should I consider before choosing a low-risk income option?

Consider factors such as your current financial situation, retirement goals, and the time horizon for your investments when choosing a low-risk income option.